Fortune's Formula

"Fortune's Formula may be the world's first history book, gambling primer, mathematics text, economics manual, personal finance guide and joke book in a single volume." — The New York Times Book Review

Parimutuel betting. Entropy. Blackjack. Arbitrage. Mobsters. Mathematicians. Stock Markets. If any of these topics tick you, this is a book you'll enjoy thoroughly. It weaves together a large number of seemingly unconnected topics and folks into a gripping story that could likely be the best primer to investing / non-fiction ever written. My top 5 highlights/quotes from the book:

1. The Kelly Criterion

The Kelly formula says that you should wager this fraction of your bankroll on a favorable bet:

edge/odds

Edge is how much you expect to win, on the average, assuming you could make this wager over and over with the same probabilities. Odds means the public or tote-board odds set by the market. It measures the profit if you win. The odds will be something like 8 to 1, meaning that a winning wager receives 8 times the amount wagered plus return of the wager itself. The odds do not factor for the Kelly gambler's inside tips.

It's easier to explain through an example. Say, the tote-board or public odds for a race horse called Secretariat winning are 5 to 1. Thus, the odds are 5/1 or just 5. However, you have an insider tip that Secretariat has a 1-in-3 chance of winning. Then, by betting $100 on Secretariat you stand a 1/3 chance of ending up with $600. On the average, that is worth 1/3 $600, or $200, which would be a net profit of $100. The edge is the $100 profit divided by the $100 wager, or simply 1. The Kelly's Formula, edge/odds is 1/5. This means you should bet one-fifth of your bankroll on the Secretariat.

2. Bet Your Beliefs

The implication of the above formula is that if you were at a race track, the best strategy is to bet your entire bankroll each race, apportioning it among the horses according to your informed estimate of each horse's chance of winning. With this system, you bet on every horse running. One horse has to win. You are certain to win one bet each race. You can never end up completely broke. There is a poetic elegance to "bet your beliefs." You play the happy fool. You ignore the odds on the tote board and bet on every horse — nothing could be more simple (-minded), and nothing achieves a better return on investment.

3. Information Equals Money

One of Kelly's equation is as beautifully daring as E=mc[2]. Kelly showed that:

Gmax = R

Here, G is the growth rate of the gambler's money. It's a way of stating the compound return on the rate of the bettor's "investment". The subscript max means that we're talking about the maximum possible rate of return. Kelly returns this optimal return to R, the information transmission rate in Shannon's Information Theory. The maximum rate of return is equal to the flow of "inside information."

To many of Einstein's contemporaries, E = mc[2] made no sense. Matter and energy were totally different concepts. Kelly's equation provokes similar mystification. Money equals information? How do you equate bits and bytes to dollars, yen and euros?

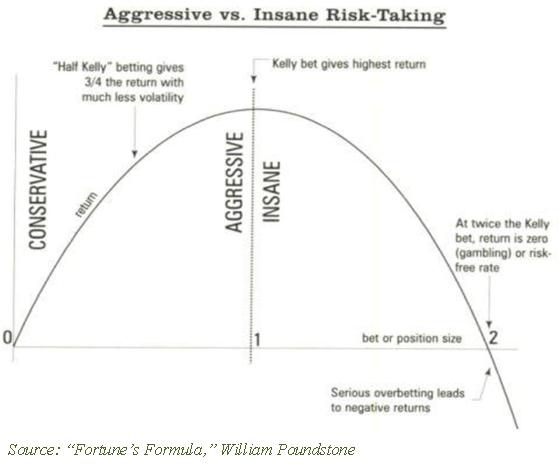

Furthermore, there's another collary to Kelly's criterion. There's a difference between aggressive vs. insane risk taking. Kelly's bet gives the highest return. Exceed it at your own peril:

4. Edward Thorpe and Princeton-Newport Partners

From Wikipedia,

Princeton/Newport Partners (P/NP) was an early alternative investment management company founded by pioneering mathematical financier Edward O. Thorp in late 1974. Thorp is the author of Beat the Dealer, which mathematically proved that the house advantage in blackjack could be overcome by card counting... In addition, Thorp, while a professor of mathematics at MIT, met Claude Shannon, and took him and his wife Betty Shannon as partners on weekend forays to Las Vegas to play roulette and blackjack, at which Thorp was very successful. His team's roulette play was the first instance of using a wearable computer in a casino — something which is now illegal, as of May 30, 1985, when the Nevada devices law came into effect as an emergency measure targeting blackjack and roulette devices.

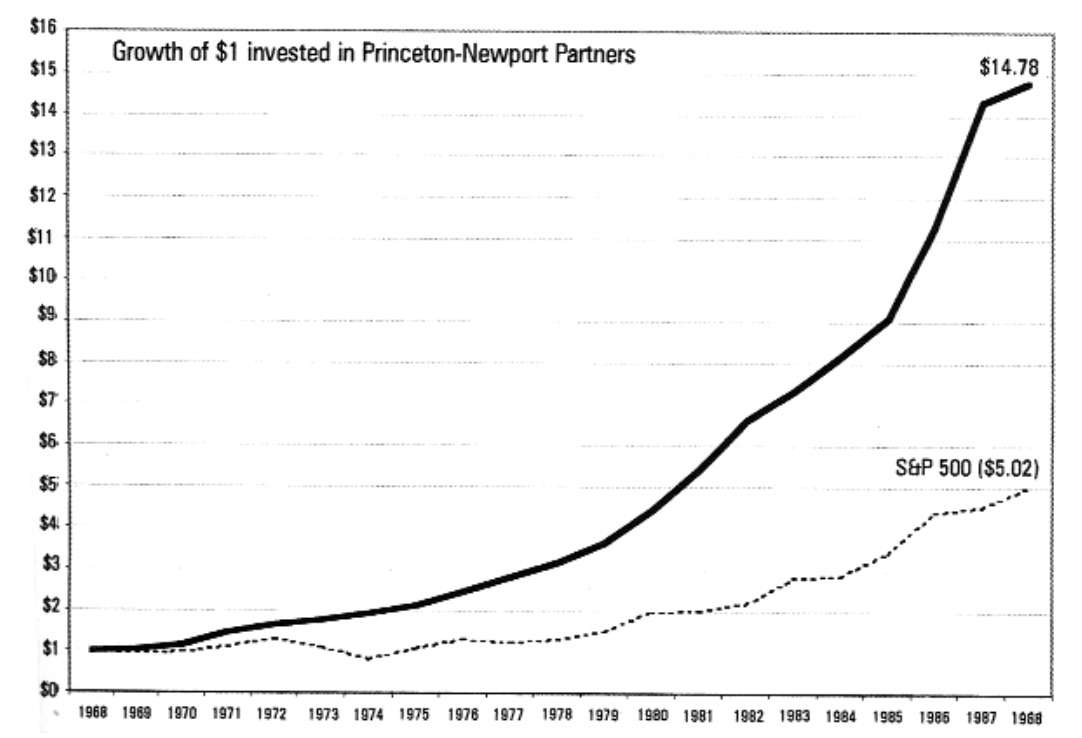

Oh, as for the performance of the Princeton-Newton Partners, I'll leave this graph here:

5. Shannon's Portfolio

When Warren Buffett bought Berkshire Hathaway in 1965, it was trading at $18 a share. By 1995 each share was worth $24,000. Over thirty years, that represents a return of 27 percent. From the late 1950s through 1986, Shannon's return on his stock portfolio was about 28 percent.

So, how did Shannon do it?

Shannon was a buy-and-hold fundamental investor... The Shannons would visit start-up technology companies and talk with the people running them... Shannon became a board member of Teledyne. He was not just a distinguished name in the annual report but was actively scouting for potential acquisitions for CEO Henry Singleton... Practically all of the profit came from the Teledyne/Motorola/Hewlett-Packard triumvirate.

Sounds like Claude Shannon was one of the best angel investors of his time — something I didn't know!

This is #51 in a series of book reviews published on this site.